As commercial and business owners increasingly rely on digital solutions and automated processes, the risk of falling victim to scams has grown. One notable threat is the rise in UCC (Uniform Commercial Code) filing scams. These fraudulent schemes can jeopardize your business's financial health and legal standing.

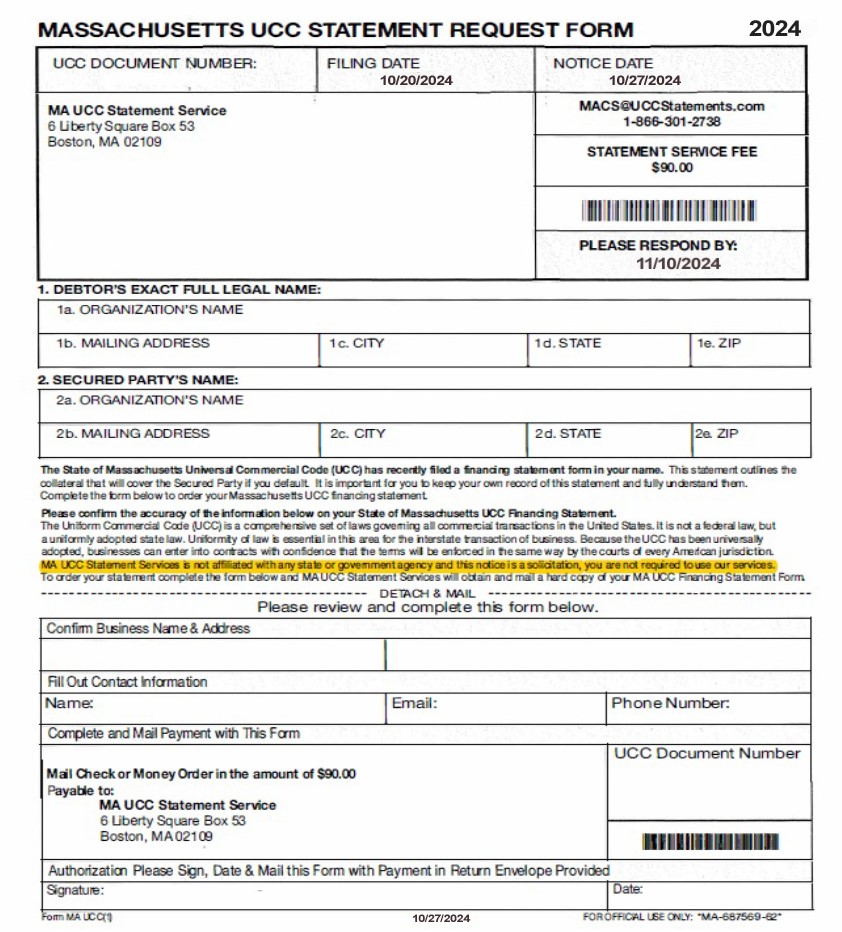

If you’ve received a form like the one below, please beware that this is not an official notice from the Commonwealth of Massachusetts.

An example of a fraudulent Massachusetts UCC Statement Request Form.

Although it appears official, the fine print states this service is not affiliated with any government agency and you are NOT required to use their services. This is a solicitation. Your information is obtained through public record resources, such as the registry of deeds or the Commonwealth of Massachusetts Secretary of State.

A request for UCC statement can be done directly through the Commonwealth of Massachusetts Secretary of State’s website.

Here’s what you need to know to protect yourself.

UCC scams typically involve fraudulent filings or misleading solicitations related to UCC-1 financing statements. These statements are public records that indicate a lender's interest in a debtor's property. Scammers exploit this system by filing false claims, which can create liens on your assets, or by sending deceptive notices that trick you into paying unnecessary fees.

Learn more about business security.

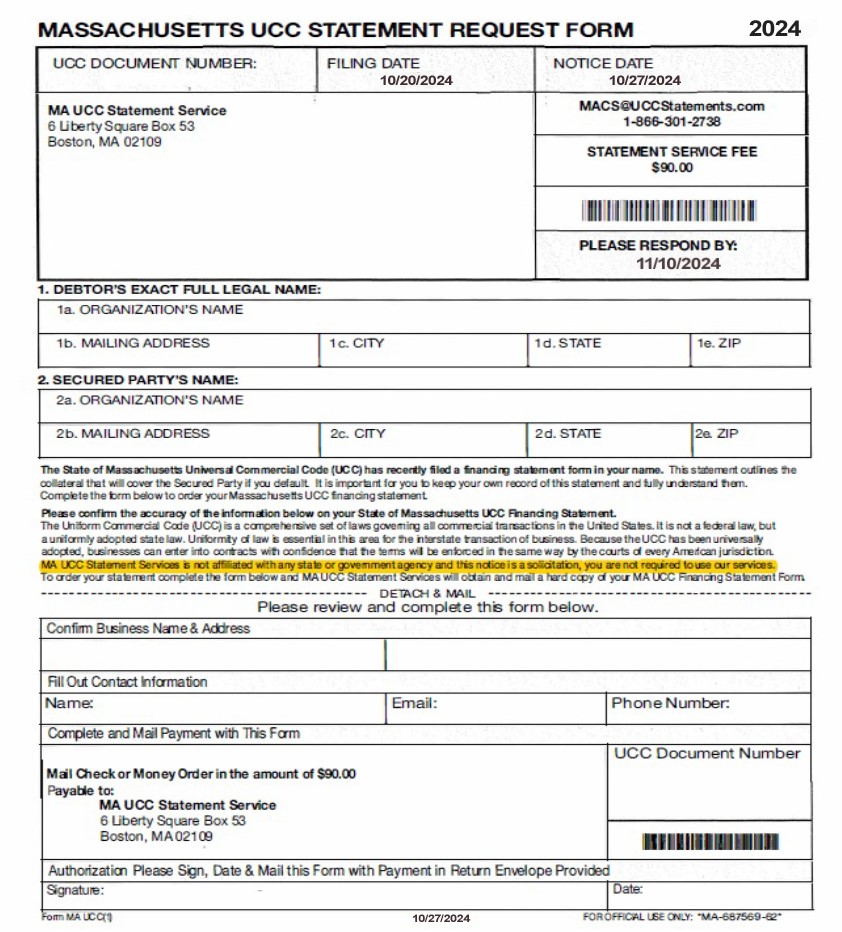

If you’ve received a form like the one below, please beware that this is not an official notice from the Commonwealth of Massachusetts.

An example of a fraudulent Massachusetts UCC Statement Request Form.

Although it appears official, the fine print states this service is not affiliated with any government agency and you are NOT required to use their services. This is a solicitation. Your information is obtained through public record resources, such as the registry of deeds or the Commonwealth of Massachusetts Secretary of State.

A request for UCC statement can be done directly through the Commonwealth of Massachusetts Secretary of State’s website.

Here’s what you need to know to protect yourself.

Understanding UCC Scams

UCC scams typically involve fraudulent filings or misleading solicitations related to UCC-1 financing statements. These statements are public records that indicate a lender's interest in a debtor's property. Scammers exploit this system by filing false claims, which can create liens on your assets, or by sending deceptive notices that trick you into paying unnecessary fees.

Common UCC Scam Tactics

- Fake UCC-1 Filings: Scammers file fraudulent UCC-1 statements against your business assets, falsely claiming a security interest. This can affect your creditworthiness and complicate financial transactions.

- Deceptive Solicitation Letters: You may receive letters that look official, urging you to pay fees to "maintain" or "renew" your UCC filings. These letters are often designed to mimic legitimate government notices but are simply attempts to extract money.

- Email Phishing Scams: Fraudsters may send emails claiming urgent action is needed regarding your UCC filings. These emails often contain links that lead to malicious websites or solicit personal information.

Steps to Protect Your Business

- Verify Filings: Regularly check the status of your UCC filings with your Secretary of State’s office to ensure no unauthorized filings have been made.

- Educate Your Team: Train your staff to recognize fraudulent solicitations and phishing attempts. Awareness is your first line of defense.

- Authenticate Communications: If you receive a suspicious letter or email, verify its legitimacy by contacting the relevant government office directly using official contact information.

- Use Trusted Professionals: Rely on legal and financial advisors to manage UCC filings and related matters.

- Report Scams: If you encounter a UCC scam, report it to the Federal Trade Commission (FTC) and the Massachusetts’s Attorney General. This helps authorities track and combat these fraudulent activities.

Conclusion

While UCC scams are a growing threat to commercial and business customers, vigilance and informed practices can significantly mitigate the risk. Stay proactive in monitoring your filings, educating your team, and verifying all communications related to UCC matters. By taking these steps, you can protect your business from the financial and legal repercussions of these scams.Learn more about business security.